City Bankers Invest in the Booming Philippine Property Market

Are You Working in the City and Wondering Where Best to Invest Your Hard Earned Cash?

Philippine Property Market Facts

- Property prices have achieved consistent steady rises over the past 5 years, averaging over 6% according to Colliers International.

- In Makati central business district the average price of a luxury 3-bedroom condominium rose 13.4% during the year to Q1 2014, to PHP136,533 (US$ 3,043, £1,975) per square metre (sq. m.) (8.98% inflation-adjusted) according to Colliers International.

- In Bonifacio Global City the average price for a 3-bedroom condominium increased by 9.5% to PHP 133,175 (US$ 2,968, £1,926) per sq. m. (5.3% inflation-adjusted), or a 1.1% q-o-q growth.

- In Rockwell Center, the increase was 9.4% to PHP 140,178 (US$ 3,124, £2,027) per sq.m. (5.1% inflation-adjusted), or a q-o-q increase of 1.0%.

- Rental yields in the Philippines are higher than all other Asian economies, averaging over 7% according to The Global Property Guide, 2015

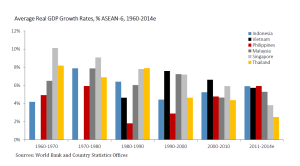

Strong Economic Outlook

- Since 2007 the Philippines has enjoyed steady growth year on year from 4.6% in 2007 through to over 6% now.

- 2nd fastest growing economy in the world after China.

- In the same period since 2007 inward investment has doubled to 4.88 billion dollars.

- Colliers International recently listed the Philippines as second in the world after India for business process outsourcing (BPO).

- Companies outsourcing to the Philippines include Accenture, Reuters, Logica, HP, United Health Group.

- Bloomberg are predicting growth averaging over 7% for the next 2 years, boosted by lower worldwide fuel prices (the Philippines are a net importer of fuel).

- The Philippines has a ‘positive’ outlook amongst credit rating agencies such as Moody’s Standard and Poors.

Get the latest investment report on Philippine properties

//

Leave a Reply

Want to join the discussion?Feel free to contribute!